If you've recently been in an accident, you may already know the difference between an insurance co-pay, and your insurance deductible. However, not everyone may understand the difference and how they affect what you pay for health coverage.

When choosing insurance plans, either in the marketplace or through an employer, you will see different amounts for co-payments (or co-pays) and for deductibles. The cost for these two different items are related, mostly because they are a part of your insurance coverage.

So, what is the difference between a co-pay and a deductible?

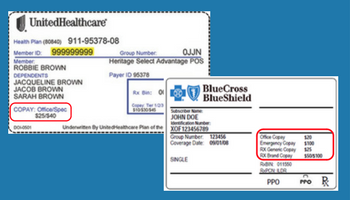

A co-pay is the fixed amount you pay each time you have a specific health related visit with a specialist. For instance, if you have a $50 co-pay with a primary care physician (or PCP) any time you visit your PCP you would pay $50. If you have a $20 prescription co-pay, you'll pay $20 for generic prescriptions. These services cost more than this, and your insurance company typically pays the rest of the bill.

A deductible is the fixed amount you can pay toward health coverage for the year. Think of deductibles like a ceiling, you will pay no more than the total deductible for the year in health care bills. If you have a $3,000 deductible, but break your leg and owe the hospital $5,000 dollars, you will pay $3,000 while your insurance company pays the rest. Any other bills you accrue for the remainder of the year (that aren't co-pay's) will be taken care of.

The Affordable Care Act (aka, Obamacare) caps your total deductible cost per year at $7,150 per individual, or $14,300 per family. While this seems like a lot, serious injuries due to car accidents add up quickly.

Having a higher deductible amount runs the risk of being caught with more bills in the case of a medical emergency or unexpected hospital visit.

While co-pay's and deductibles are all paying for health care coverage, it's also important to know that your co-pay's usually won't count toward reaching your deductible limit. Many health care coverages offer a lower co-pay amount, if you're willing to risk a higher deductible amount, increasing your out of pocket expenses in the case of emergency.

If you've been in a car accident, and your health care bills are adding up, call us so we can help sort it out. You don't have to do it alone.